Market Trends - May 2018

------------------------------------------------------------

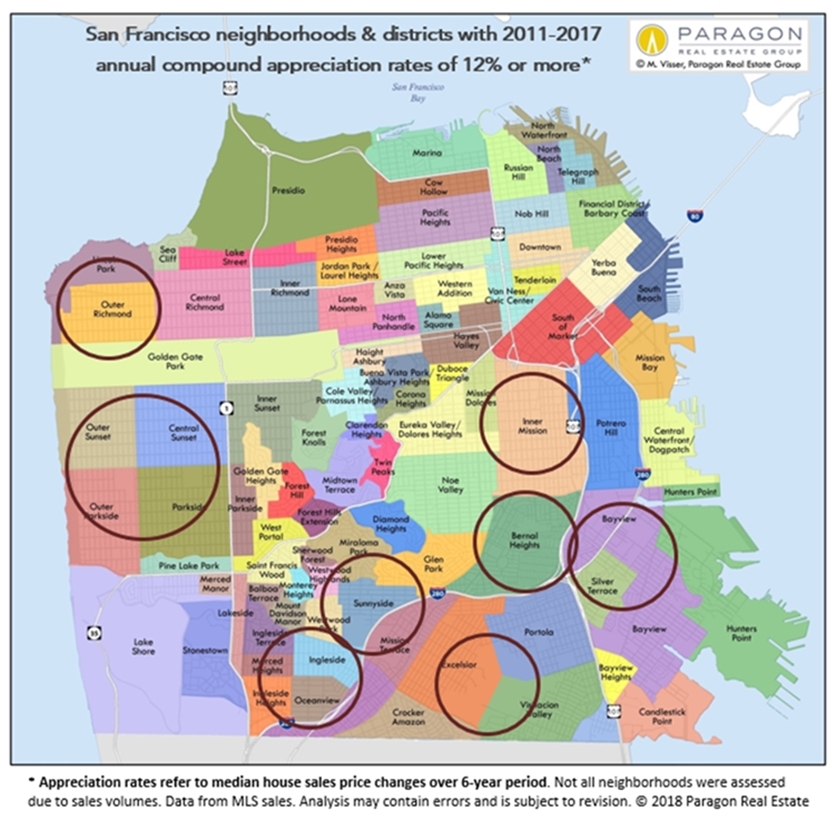

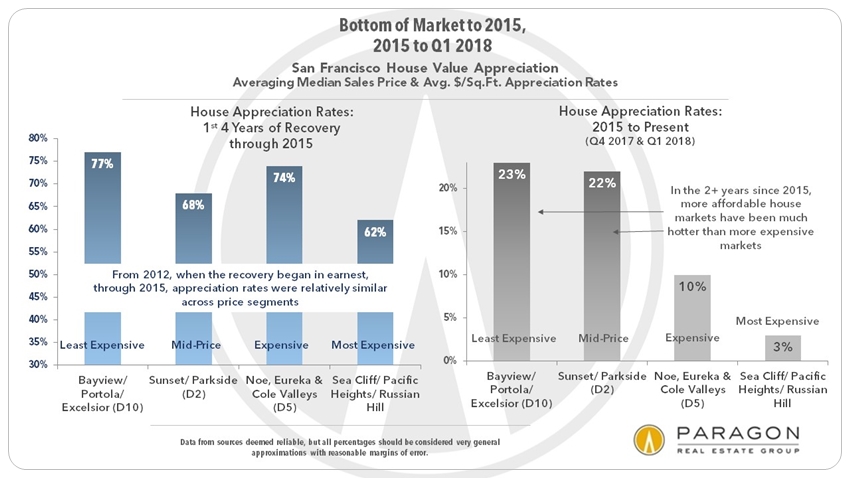

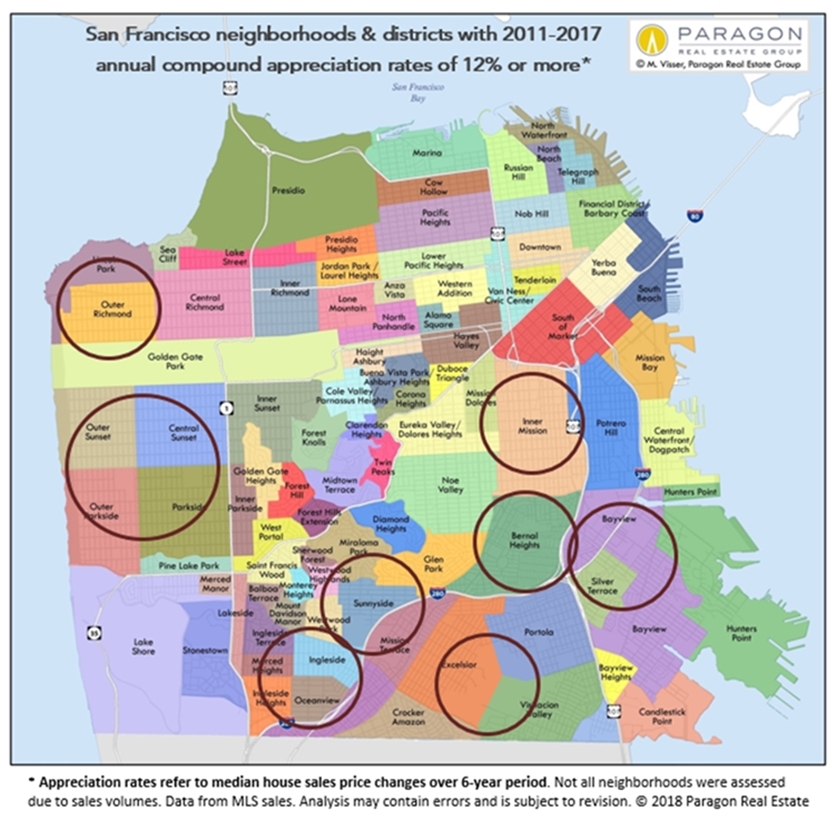

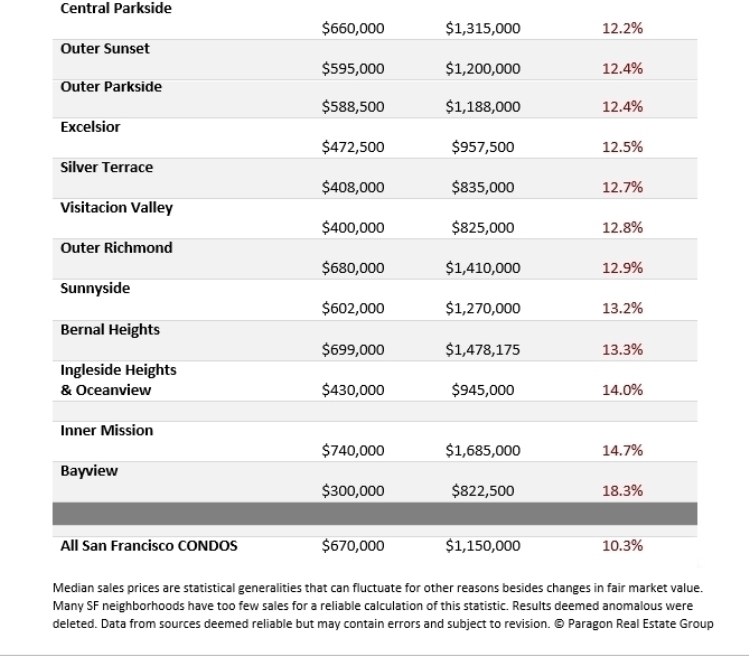

Highest Median House Price Appreciation Rates by Neighborhood:

Compound Annual Appreciation Percentages, 2011 – 2017

The neighborhoods and districts circled on the map below have seen compound annual appreciation rates of 12% or more over the past 6 years. As a point of comparison, the national rate over that period was about 7%, and the CPI inflation rate about 1.5%. As illustrated in the table below the map, the highest rate in San Francisco over the period was above 18%.

If the return on cash investment was calculated for purchasing with a 20% down payment (instead of paying all cash), and adjusting for closing costs (estimated at 2% on buy-side, 7% on sell side), the compound annual rate of return on the cash investment soars: A 10% annual rate of home price appreciation would then translate into an annual compound return on cash investment of just under 40%. The use of financing in homeownership is one of the reasons why it can often be such a good investment to develop household wealth over time.

Total 6-year appreciation rates can be calculated by dividing the 2017

median house sales price by the 2011 price.

Though median home price appreciation rates throughout the city have been incredibly high by any reasonable measure, some neighborhoods have outpaced the norm. The main reason is affordability: Less expensive homes have appreciated considerably faster than more expensive homes. Also, some of the most affordable districts were hammered by foreclosure sales after the 2008 crash, which brought their sales prices down to unnatural lows by 2011 - setting the stage for dramatic recoveries. Bayview, with the most affordable houses in San Francisco and also worst hit by the 2008-2011 distressed property crisis, has had the highest compound annual appreciation rate since that time, a staggering 18.3%, or a 6-year total rate of 174%. Other affordable neighborhoods running across the southern border of the city - such as Excelsior, Visitacion Valley, Sunnyside, Ingleside and Oceanview - also saw extremely high annual rates of 12% to 14% for similar reasons.

The dynamic in the Inner Mission was somewhat different: Its 14.7% compound annual rate of appreciation - a total of 128% over the 6 years – was because it turned into the hottest, hippest district in the city, especially among younger high-tech workers. The gentrification which had been slowly occurring for 30 years suddenly went into overdrive to catapult prices higher.

Bernal Heights - with a 13.3% compound annual rate and 111% 6-year total - is right next to the Mission on one side and to Noe Valley on another. It was perfectly situated to take advantage of the classic overflow effect for people who wanted a similar neighborhood ambiance to Noe or Eureka Valley, but could no longer afford their much higher prices. Outer Richmond was also a standout: It has the lowest house prices in the northern third of the city. And the Sunset & Parkside district is filled with mid-price 2 and 3 bedroom houses, has a variety of attractive neighborhood commercial districts, ocean or parks on 3 sides, and easy access to highways south to the peninsula. All these factors have made it into a much sought-after location to purchase a home in recent years. The market there is insanely hot now.

The most expensive neighborhoods in the city have lower, but still very high rates of appreciation. And in dollar terms, their appreciation returns are by far the highest in the city.

CONDOS: Calculating appreciation rates for San Francisco neighborhood condo prices is an iffier process, because so many large, new condo projects have come on market, significantly impacting inventory and sales prices, and making it much more difficult to perform apples to apples comparisons. Therefore, our calculations, above and below, are performed for the entire city instead of for separate districts. It is certainly true that, due to supply and demand issues, condos have typically appreciated at somewhat lesser rates than houses, which have become the scarce commodity in San Francisco. There has been some variation in condo appreciation rates depending on location, supply and price segment.

------------------------------------------------------------

Up, Down, Up: A Longer-Term Look

at San Francisco Home Value Changes since 2000

Bubble, Crash & Recovery

by District & Price Segment

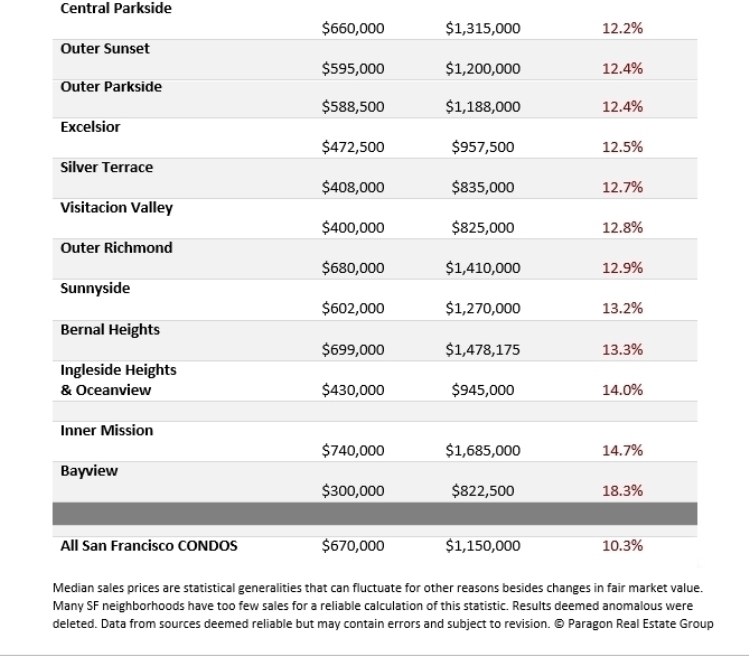

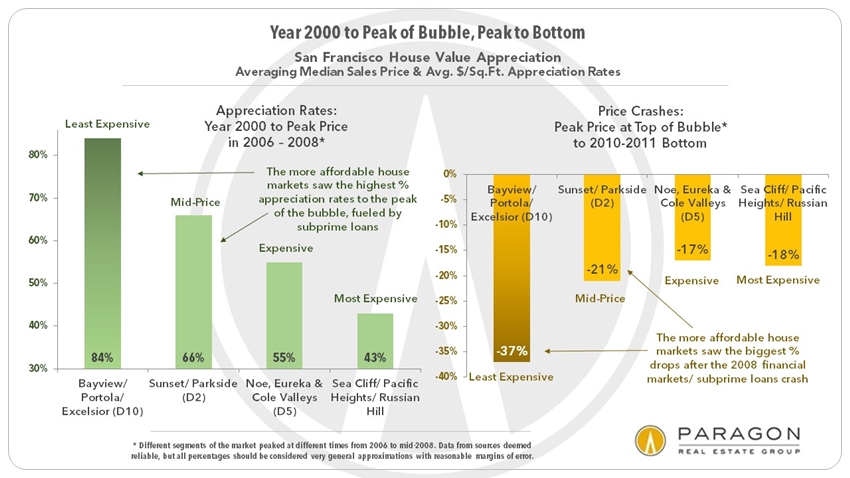

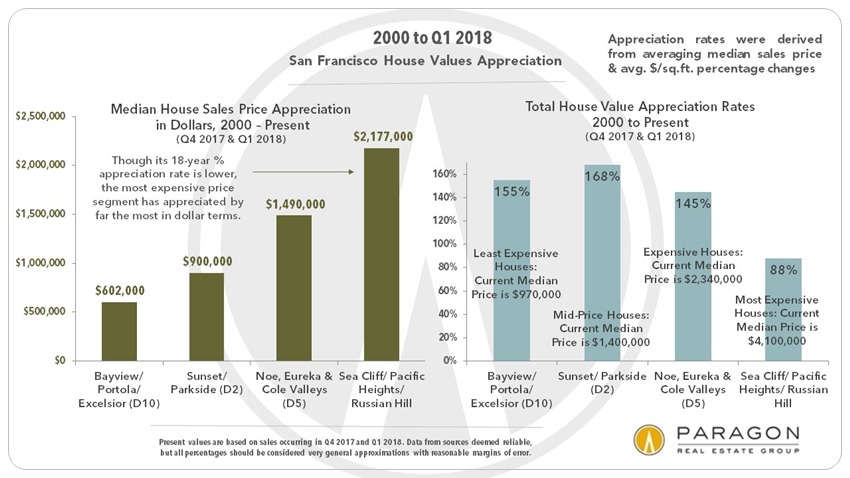

Home value appreciation in the charts below is broken down by 4 distinct time periods: 1) 2000 to peak of bubble (2006-2008, depending on price segment); 2) peak of bubble to bottom of market (typically 2011); 3) the 1st 4 years of the recovery, 2012 to 2015; and 4) 2015 to present.

House appreciation is broken down into 4 broad price segments as exemplified by the markets in 4 city regions: The least expensive segment is represented by house sales in the broad swathe of southern neighborhoods running from Bayview through Portola, Excelsior, Crocker Amazon and Outer Mission (Realtor district 10). The mid-price segment is illustrated by sales in the Sunset & Parkside district (Realtor district 2). The central Noe, Eureka & Cole Valleys district (district 5) is used to represent the expensive segment; and the very expensive house segment is illustrated by the northern, old-prestige neighborhoods running from Sea Cliff, Lake Street & Jordan Park through Pacific & Presidio Heights, Cow Hollow and Marina to Russian, Nob & Telegraph Hills (which are the very affluent parts of 3 different Realtor districts).

These areas were used because of their quantity of sales and the relative homogeneity of values within them. For condos, appreciation rates were calculated on the entire San Francisco condo market. The calculations below were made by averaging both median sales price and average dollar per square foot appreciation rates. Present values are based on sales occurring in Q4 2017 and Q1 2018.

2000 to Peak of Bubble,

Crash to Bottom of Market

Less expensive homes saw by far the biggest bubbles (2000 to 2006-2008) and crashes (2008-2011), mostly due to the predatory lending/ subprime financing crisis. This was a phenomenon across Bay Area markets. (Note that different price segments peaked in different years from 2006 to mid-2008.)

Bottom of Market to 2015,

2015 to Present

The first 4 years of the recovery which began in 2012 saw high home-price appreciation rates across the city. In 2015, the market shifted - there was considerable financial market volatility in late 2015 and the first half of 2016, a precipitous drop in IPO activity, and the high-tech boom cooled temporarily - and appreciation rates diverged, with less expensive homes significantly outpacing more expensive neighborhoods. One factor was that buyers were desperately searching for homes they could still afford.

Overall Dollar & Percentage Appreciation

2000 to Present

By total percentage appreciation since 2000, Sunset/Parkside ranks first. By actual dollar appreciation, the most expensive home prices increased the most, typically by well into seven figures.

San Francisco Condo Appreciation

2000 to Present, All Districts

Generally speaking, the San Francisco condo market has not seen appreciation rates as high as for houses. Mostly, this has to do with increasing supply due to the boom in new condo construction, but it was also affected by factors in 2015-2016 already described above.

------------------------------------------------------------

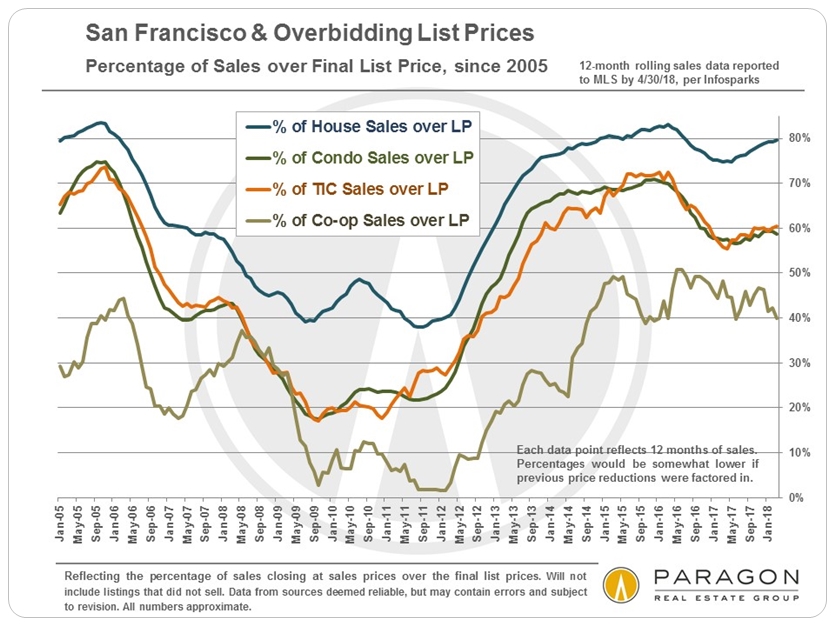

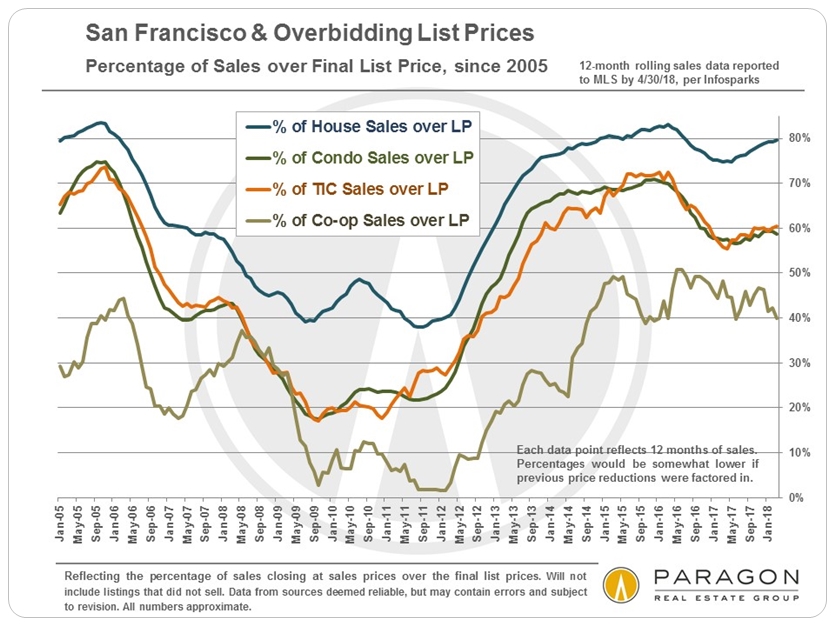

Percentage of Sales over List Price

by Property Type

This chart illustrates the difference in demand by property type.

Houses have been the hottest segment in recent years.

------------------------------------------------------------

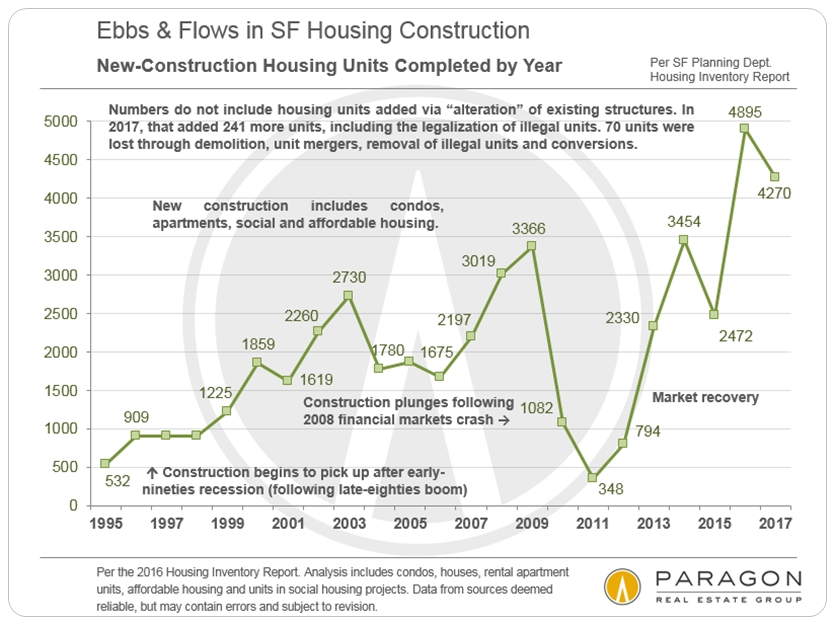

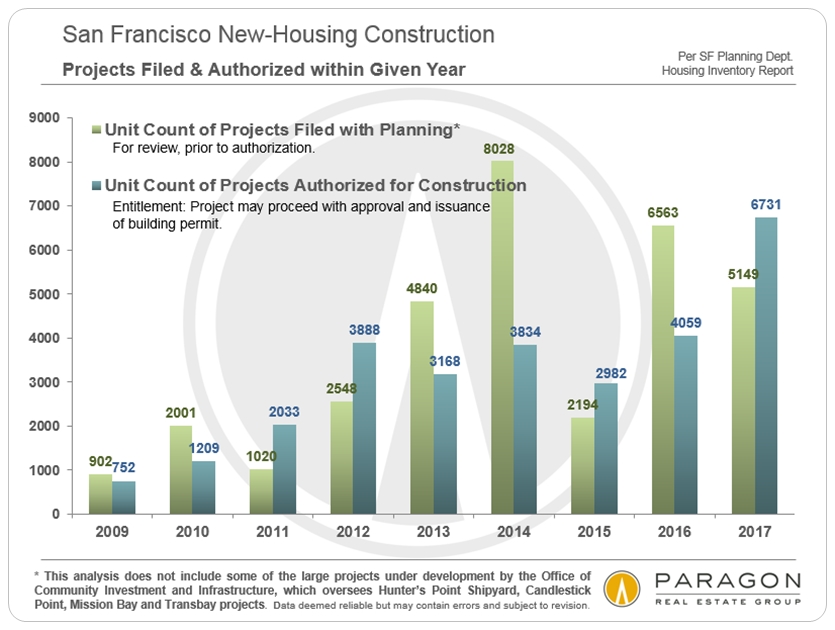

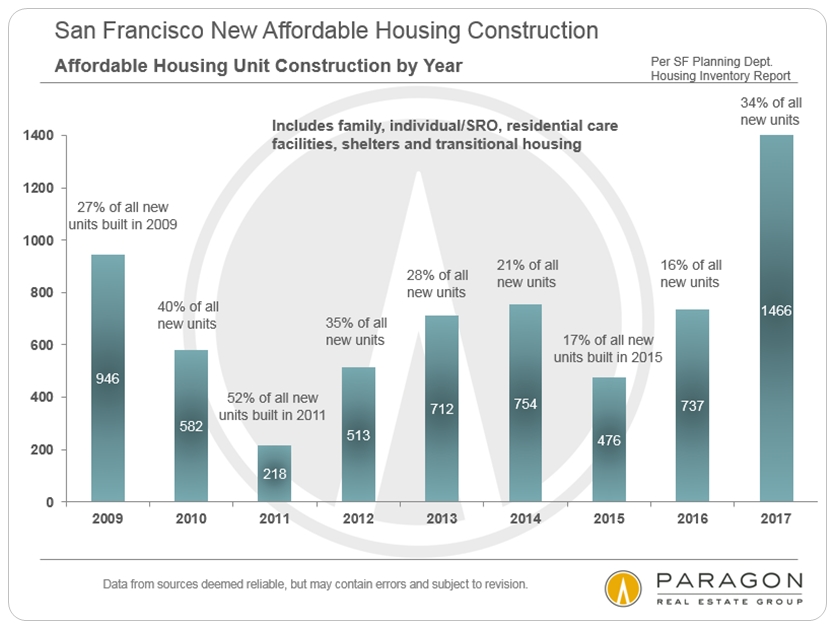

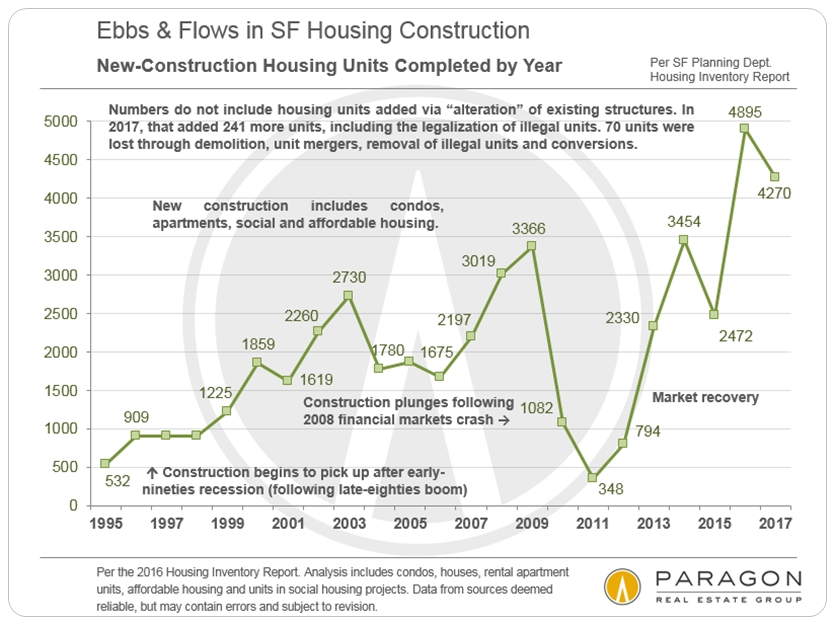

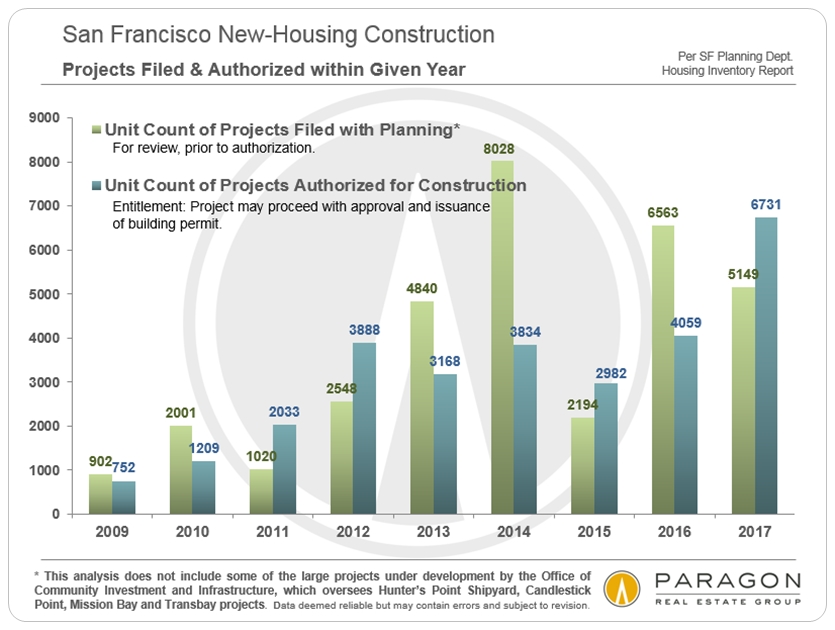

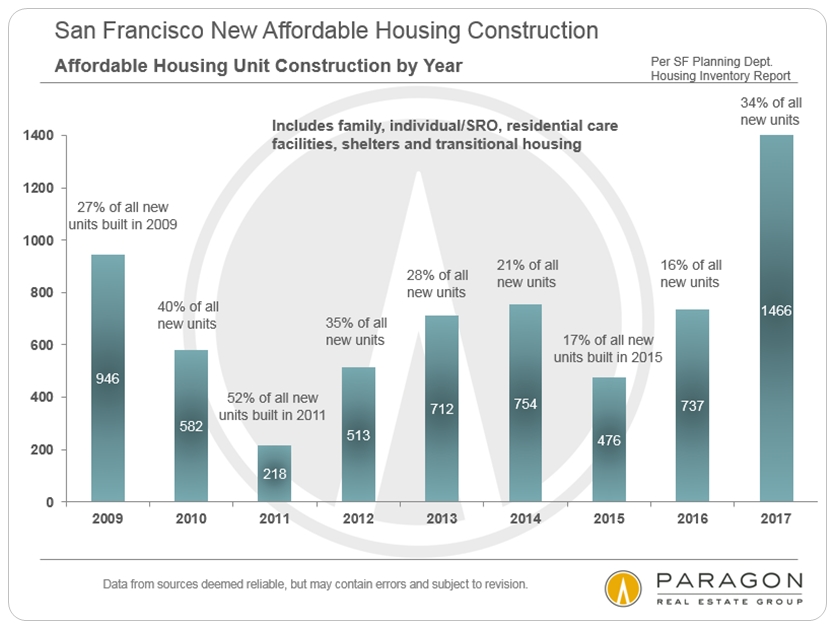

San Francisco New-Housing Trends

New construction, projects authorized, and affordable housing figures

based on San Francisco Planning Department data recently released for 2017

------------------------------------------------------------

Highest Median House Price Appreciation Rates by Neighborhood:

Compound Annual Appreciation Percentages, 2011 – 2017

The neighborhoods and districts circled on the map below have seen compound annual appreciation rates of 12% or more over the past 6 years. As a point of comparison, the national rate over that period was about 7%, and the CPI inflation rate about 1.5%. As illustrated in the table below the map, the highest rate in San Francisco over the period was above 18%.

If the return on cash investment was calculated for purchasing with a 20% down payment (instead of paying all cash), and adjusting for closing costs (estimated at 2% on buy-side, 7% on sell side), the compound annual rate of return on the cash investment soars: A 10% annual rate of home price appreciation would then translate into an annual compound return on cash investment of just under 40%. The use of financing in homeownership is one of the reasons why it can often be such a good investment to develop household wealth over time.

Total 6-year appreciation rates can be calculated by dividing the 2017

median house sales price by the 2011 price.

The dynamic in the Inner Mission was somewhat different: Its 14.7% compound annual rate of appreciation - a total of 128% over the 6 years – was because it turned into the hottest, hippest district in the city, especially among younger high-tech workers. The gentrification which had been slowly occurring for 30 years suddenly went into overdrive to catapult prices higher.

Bernal Heights - with a 13.3% compound annual rate and 111% 6-year total - is right next to the Mission on one side and to Noe Valley on another. It was perfectly situated to take advantage of the classic overflow effect for people who wanted a similar neighborhood ambiance to Noe or Eureka Valley, but could no longer afford their much higher prices. Outer Richmond was also a standout: It has the lowest house prices in the northern third of the city. And the Sunset & Parkside district is filled with mid-price 2 and 3 bedroom houses, has a variety of attractive neighborhood commercial districts, ocean or parks on 3 sides, and easy access to highways south to the peninsula. All these factors have made it into a much sought-after location to purchase a home in recent years. The market there is insanely hot now.

The most expensive neighborhoods in the city have lower, but still very high rates of appreciation. And in dollar terms, their appreciation returns are by far the highest in the city.

CONDOS: Calculating appreciation rates for San Francisco neighborhood condo prices is an iffier process, because so many large, new condo projects have come on market, significantly impacting inventory and sales prices, and making it much more difficult to perform apples to apples comparisons. Therefore, our calculations, above and below, are performed for the entire city instead of for separate districts. It is certainly true that, due to supply and demand issues, condos have typically appreciated at somewhat lesser rates than houses, which have become the scarce commodity in San Francisco. There has been some variation in condo appreciation rates depending on location, supply and price segment.

------------------------------------------------------------

Up, Down, Up: A Longer-Term Look

at San Francisco Home Value Changes since 2000

Bubble, Crash & Recovery

by District & Price Segment

House appreciation is broken down into 4 broad price segments as exemplified by the markets in 4 city regions: The least expensive segment is represented by house sales in the broad swathe of southern neighborhoods running from Bayview through Portola, Excelsior, Crocker Amazon and Outer Mission (Realtor district 10). The mid-price segment is illustrated by sales in the Sunset & Parkside district (Realtor district 2). The central Noe, Eureka & Cole Valleys district (district 5) is used to represent the expensive segment; and the very expensive house segment is illustrated by the northern, old-prestige neighborhoods running from Sea Cliff, Lake Street & Jordan Park through Pacific & Presidio Heights, Cow Hollow and Marina to Russian, Nob & Telegraph Hills (which are the very affluent parts of 3 different Realtor districts).

These areas were used because of their quantity of sales and the relative homogeneity of values within them. For condos, appreciation rates were calculated on the entire San Francisco condo market. The calculations below were made by averaging both median sales price and average dollar per square foot appreciation rates. Present values are based on sales occurring in Q4 2017 and Q1 2018.

Crash to Bottom of Market

Bottom of Market to 2015,

2015 to Present

Overall Dollar & Percentage Appreciation

2000 to Present

San Francisco Condo Appreciation

2000 to Present, All Districts

------------------------------------------------------------

Percentage of Sales over List Price

by Property Type

This chart illustrates the difference in demand by property type.

Houses have been the hottest segment in recent years.

------------------------------------------------------------

San Francisco New-Housing Trends

New construction, projects authorized, and affordable housing figures

based on San Francisco Planning Department data recently released for 2017

------------------------------------------------------------