Oakland-Berkeley Market Trends Report - September 2020

Oakland-Berkeley Inner East Bay Real Estate

September 2020 Report

In the context of the horrible fires we've seen in recent weeks - with many of our Bay Area communities and neighbors so terribly affected - a real estate report seems trivial. But since we have clients still trying to make buying and selling decisions, we will try to continue to deliver straightforward data on market conditions.

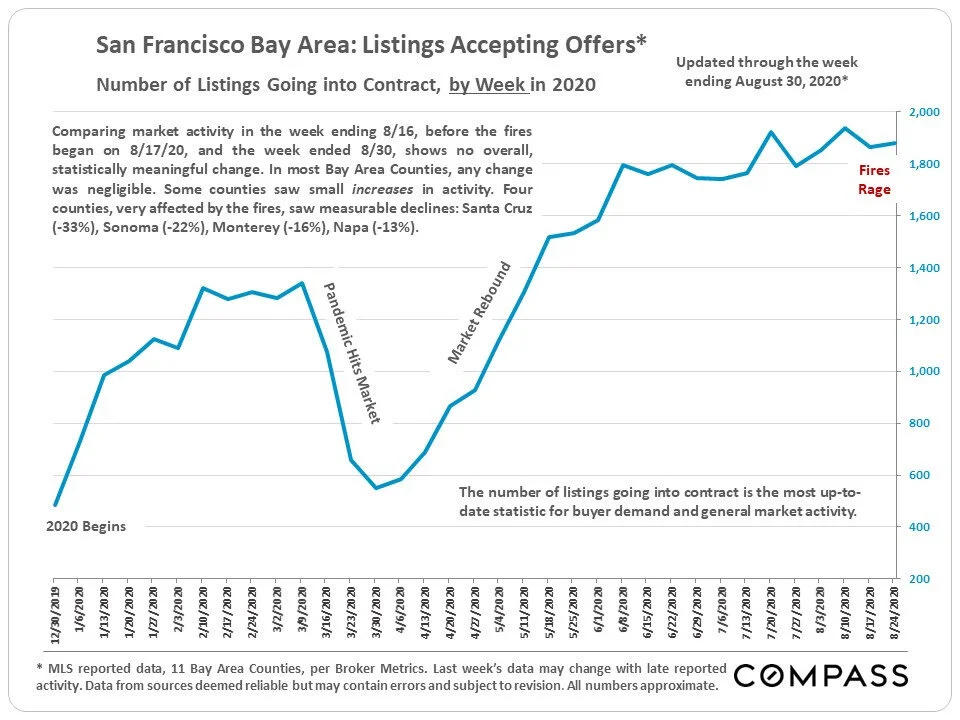

Surprisingly, the fires did not significantly impact the number of deals being made in most Bay Area counties during the last 2 weeks of August - the exceptions being Santa Cruz, Sonoma, Monterey and Napa Counties, which saw declines of 13% to 33%.

Comparing the second week of August (before the fires) to the fourth week (deep in crisis), the Inner East Bay market actually saw a small increase in the number of listings going into contract. (This chart looks at week by week activity in the Bay Area.)

Market indicator: The number of listings going into contract by month. Typically, spring is a very active selling season followed by a slowdown in summer, but the pandemic changed that dynamic. Usually, there is an autumn spike in activity - we'll have to wait and see if that occurs this year. Certainly, buyer demand has, so far, shown no signs of wilting.

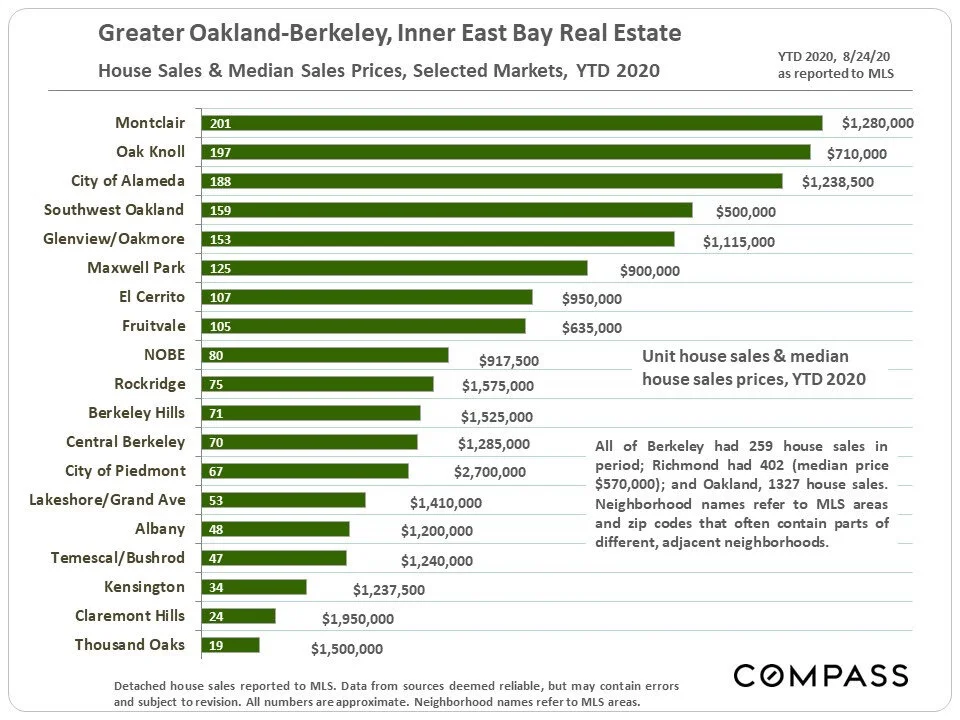

Year-to-date house sales volumes and median house sales prices in selected Inner East Bay markets:

Bay Area median house sales price in summer 2020:

Median house sales price trends for the Inner East Bay:

Median condo sales price trends in Alameda County:

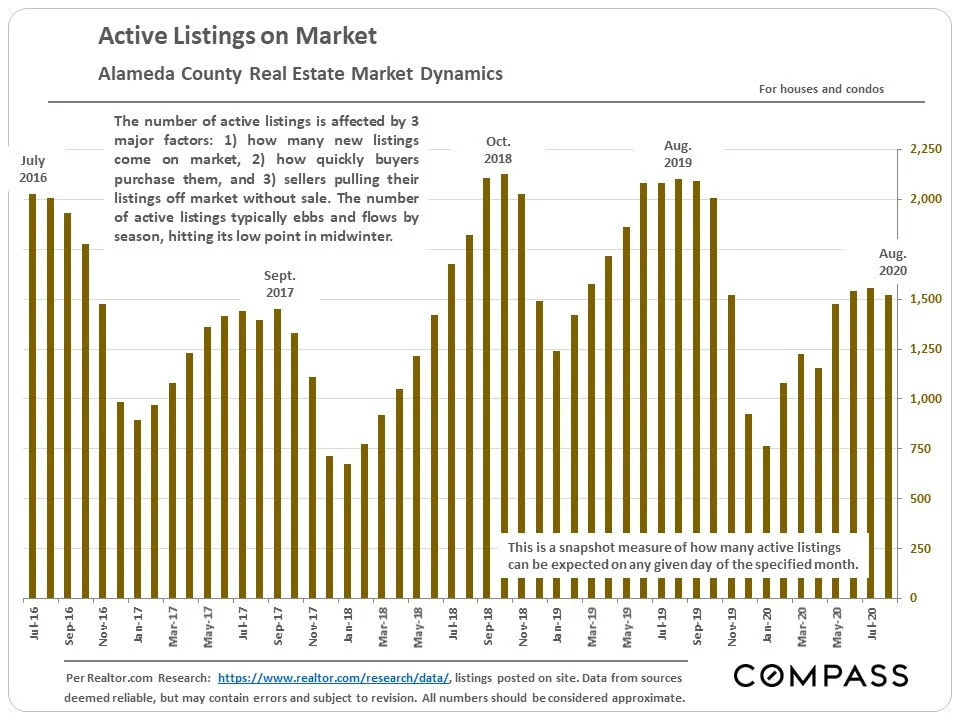

A snapshot measure of how many listings were typically active in Alameda County on any given day of the specified month: Inventory remains low.

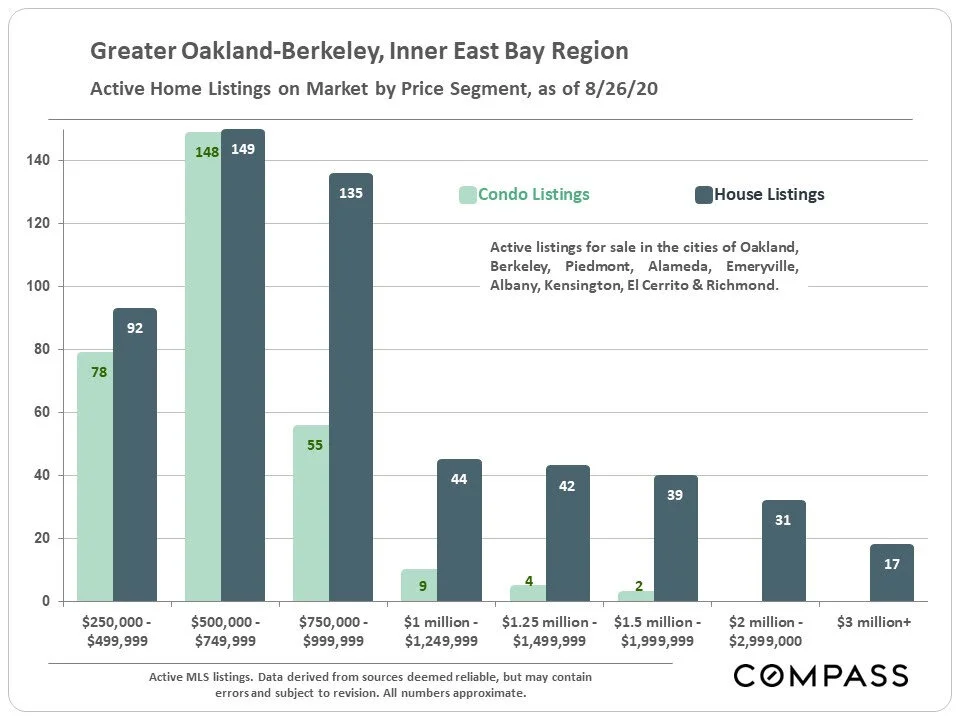

Active listings on the market in late August, broken out by price segment: These numbers change every day with ongoing market activity.

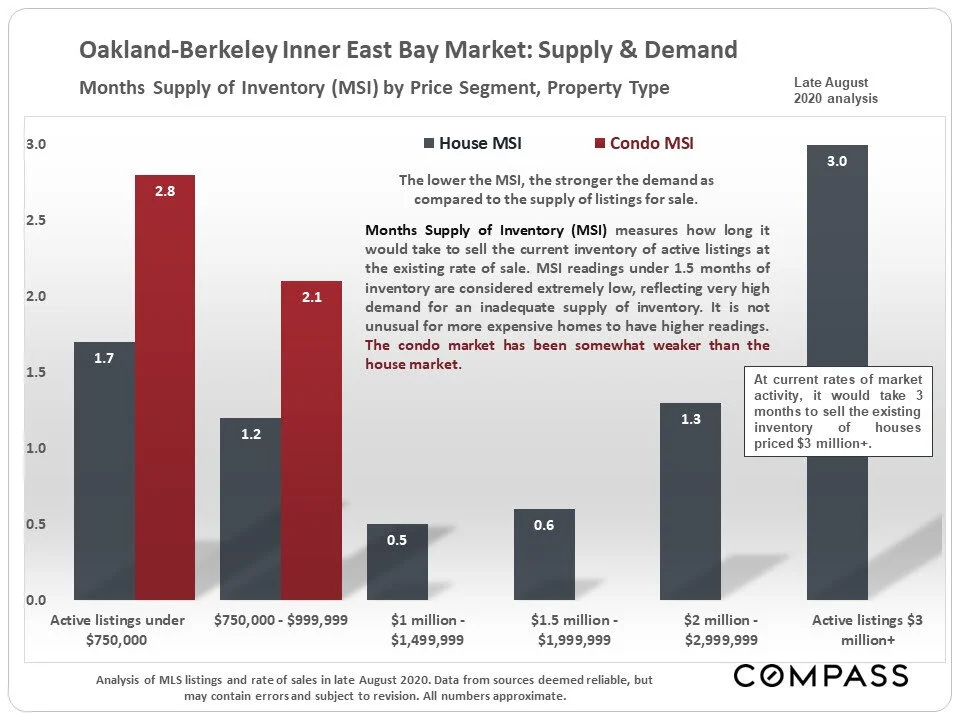

The lower the Months Supply of Inventory (MSI), the stronger the demand as compared to the supply of listings for sale. Most of the market remains deeply in "seller's market" territory by this measure - some price segments are extremely heated.

As is the case in most other major markets, buyer demand for condos (red columns in next chart) is somewhat softer than the demand for houses. This is illustrated in both charts following.

The number of Alameda County price reductions remains quite low by historical standards.